- Learn the critical categories of commercial real estate data, from zoning records for compliance to tenant data for enhancing relationships. Structured data supports better decision-making and operational efficiency.

- Explore how to harness data from trusted sources like government registries, property platforms, and advanced market research tools. Regularly validate and update this data for improved accuracy and usability.

- Understand how stakeholders use commercial real estate data to improve forecasting, streamline operations, and stay ahead in a competitive market.

Table of Contents

Commercial real estate thrives on data-driven decisions, making the types and sources of data critical to success. From acquisitions and lease management to market forecasting and tenant relations, the value of robust and well-structured real estate data cannot be overstated. Property records, lease agreements, market analytics, and zoning information represent just a fraction of the vast datasets that influence every stage of real estate operations.

Commercial real estate data providers strategically empowers stakeholders to make informed decisions, boosting operational efficiency and fostering long-term growth. In a competitive and dynamic industry, leveraging the right data is the key to transforming information into actionable insights and driving success in commercial real estate management. Here are the distinct types of commercial real estate data. Professionals can seize hidden opportunities, identify risks and navigate market complexities with greater confidence.

Key Types of Commercial Real Estate Data

Precise and systematically categorized data are the cornerstone of every successful commercial real estate decision. From tenant demographics and lease terms to detailed property valuations and market trends, the real estate industry depends heavily on accurate, organized, and actionable insights. Learn about the different types of commercial real estate data and how they support various stakeholders in commercial real estate transactions.

Commercial Property Data

In commercial real estate (CRE), property data serves as the foundation for strategic decision-making. Every data point reveals insights that help stakeholders, including investors, developers, brokers, and appraisers, evaluate a property’s value, performance potential, and long-term viability. Here’s a closer look at the essential property data elements in CRE and their strategic implications.

| Aspect | What It Includes | How It Helps |

|---|---|---|

| Property Type | Classification such as office, retail, industrial, multifamily, or mixed-use. | Determines the property’s market segment and its suitability for different types of tenants or investors. |

| Location and Address | Specific address and geographic details of the property. | Helps assess accessibility, market demand, and regional growth potential. |

| Size and Floor Plans | Total square footage, number of floors, and layout details. | Supports valuation, tenant fit-out planning, and capacity assessments. |

| Occupancy and Lease Information | Current occupancy rates, tenant details, lease terms, and expiration dates. | Enables revenue forecasting, tenant management, and lease negotiation strategies. |

| Building Age and Condition | Construction date, maintenance history, and current state of the property. | Provides insights for redevelopment potential, maintenance needs, and depreciation analysis. |

| Sales and Rental History | Historical sales prices, rental rates, and transaction trends. | Aids in assessing market value, identifying trends, and making data-driven investment decisions. |

| Amenities and Features | Details on facilities such as parking, elevators, HVAC systems, and energy-efficient features. | Enhances property appeal and marketability by showcasing features that attract tenants and buyers. |

| Environmental, Social, and Governance (ESG) Data | Data on energy efficiency, carbon footprint, and compliance with social and governance standards. | Helps align with sustainability goals, attract ESG-conscious investors, and meet regulatory requirements. |

Why Property Data Matters for Commercial Real Estate Success

Effective use of property data is more than just record-keeping; instead, it’s a competitive advantage in commercial real estate.

Here’s how:

- Informed Valuation: Data-backed insights help appraisers and investors determine accurate property values based on historical performance and market conditions.

- Risk Mitigation: Understanding lease structures, occupancy rates, and ESG factors allows for better risk assessment and long-term investment planning.

- Strategic Redevelopment: Older properties with strong location data and size flexibility can be reimagined for higher profitability.

- Enhanced Deal Transparency: Comprehensive property data foster trust among stakeholders, reducing due diligence timelines in transactions.

Market Data

Market data documents play a crucial role in providing an in-depth understanding of the overall commercial real estate (CRE) market. They encompass a wide range of reports and analyses designed to evaluate market health, demand and competitiveness.

Below is a breakdown of the types of documents within this category, their details and how they assist stakeholders.

| Type of Document | Details | How It Helps |

|---|---|---|

| Market Size and Segmentation | Analyzes the total market size in terms of square footage or asset value, segmented by property type, geography, or property class (A, B, C). | Identifies lucrative market segments and regions, helping stakeholders focus on areas with the highest growth potential. |

| Supply and Demand Reports | Examines the balance between property availability and market demand, including new constructions and tenant requirements. | Predicts market trends, identifies risks of oversupply or undersupply, and aids in planning investment or development strategies. |

| Vacancy Rates and Absorption | Provides data on unoccupied properties (vacancy rates) and the rate at which available spaces are leased (absorption rates), segmented by type and area. | Indicates market demand strength; low vacancy and high absorption trends signal investment opportunities, while high vacancy suggests caution. |

| Rental Rates and Sales Prices | Details average rental rates, price per square foot, and transaction trends, often including forecasts. | Helps calculate potential ROI, evaluate revenue opportunities, and negotiate leases or property deals effectively. |

| Economic Indicator Reports | Covers macroeconomic factors like employment rates, GDP, inflation, interest rates, and regional economic conditions. | Offers insights into how broader economic factors influence property demand and pricing, enabling market timing and risk assessment. |

| Demographic Studies | Analyzes population growth, income levels, age distribution, household sizes, and migration patterns. | Predicts consumer behavior and property demand; for example, areas with younger populations might favor multifamily housing. |

| Development Activity Reports | Tracks ongoing projects, planned developments, and future pipelines with details like timelines and project types. | Assesses future supply, helping stakeholders anticipate market changes and plan project timing or investment entry points. |

Significance of Market Data Documents in CRE

Market data documents provide a holistic view of the CRE landscape. They enable stakeholders, including investors, developers, property managers and tenants, to:

- Evaluate Market Health: Identify strong and weak markets based on vacancy rates, demand, and pricing trends.

- Make Informed Decisions: Base investment, development, or leasing decisions on reliable data.

- Assess Competitiveness: Compare the relative attractiveness of different markets or segments.

- Plan Strategically: Align projects and investments with market dynamics, avoiding potential risks.

Financial Data

Financial data documents are not just numbers on a page—they are the cornerstone of every informed decision in commercial real estate. They provide an unfiltered view of a property’s financial health, helping investors spot opportunities, lenders assess risks, and property managers unlock potential. These documents hold the answers to questions every decision maker must ask: Is this property worth it? Will it perform? How do we make it better?

| Type of Document | Details | How It Helps |

|---|---|---|

| Operating Expense Reports | Lists recurring expenses such as taxes, insurance, maintenance, utilities, and management fees. | Evaluates cost structure, identifies areas for cost reduction, and calculates net profitability. |

| Net Operating Income (NOI) | Highlights income-generating capability by subtracting operating expenses from rental income. | Assesses profitability, compares property performance, and determines cash flow potential. |

| Capitalization (Cap) Rates | Provides ROI insights by dividing NOI by the property’s market value. | Compares investment opportunities and assesses the risk-reward balance of properties. |

| Loan Terms and Debt Service | Details mortgage terms, interest rates, repayment schedules, and debt service coverage ratios (DSCR). | Ensures financing feasibility, manages debt obligations, and prevents over-leveraging. |

| Investment Performance Metrics | Tracks IRR, cash-on-cash returns, and ROI, including historical and projected data. | Offers a clear view of investment success, aids in portfolio optimization, and informs strategic planning. |

Tenant Data

Commercial tenant data documents are critical components in commercial real estate (CRE), as they provide a detailed view of tenant profiles, lease agreements, and occupancy metrics.

Key Components of Tenant Data Documents in CRE:

| Aspect | What It Includes | How It Helps |

|---|---|---|

| Tenant Creditworthiness and Financial Stability | Reports on tenants’ credit history, financial statements, and payment reliability. | Minimizes risk of defaults, ensures consistent cash flow, and identifies financially stable tenants for long-term security. |

| Tenant Industry and Business Performance | Insights into tenants’ industry trends, market reputation, and business growth trajectory. | Anticipates risks from underperforming tenants and enables proactive replacement or strategic adjustments. |

| Tenant Lease Terms and Expiration Dates | Details on lease agreements, including start/end dates, renewal options, rental rates, and escalations. | Streamlines lease management, reduces vacancy periods, and supports better negotiation for renewals or new leases. |

| Tenant Satisfaction and Retention Rates | Surveys, feedback, and metrics reflecting tenant contentment with property and management services. | Improves retention, reduces turnover costs, and ensures stable occupancy with happy tenants likely to renew leases. |

Significance of Tenant Data in CRE Documentation:

Tenant data offers insights that help property owners, investors, and asset managers forecast revenue stability, assess risk, and make informed decisions about property performance and tenant management strategies.

- Revenue Forecasting: Lease expiration dates, rental terms, and occupancy rates help project future income and identify potential gaps.

- Risk Mitigation: Tenant creditworthiness and financial health allow proactive identification of default risks.

- Portfolio Optimization: Tracking tenant satisfaction and lease terms enables strategic planning for renewals and property improvements.

- Investor Transparency: Providing clear tenant data enhances confidence in asset performance and income stability for stakeholders.

- Loan Approvals: Lenders often review tenant stability metrics, especially in multitenant properties, before approving financing.

Demographic & Location Data

Demographic and location data is a vital tool for understanding the potential of a property and its surroundings. It provides insights into the area’s accessibility, population, safety, and regulatory environment, allowing stakeholders to make informed decisions. Here’s an overview of the key elements of demographic and location data and their significance.

| Aspect | What It Includes | How It Helps |

|---|---|---|

| Proximity to Transportation, Amenities, and Services | Accessibility to public transportation, major roads, shopping centers, schools, healthcare facilities, and recreational spaces. | Enhances the property’s appeal, increases tenant satisfaction, and boosts demand by ensuring convenience and accessibility. |

| Neighborhood Demographics and Socioeconomic Factors | Information on population size, age distribution, income levels, education attainment, employment statistics, and household composition. | Assists in tenant targeting by aligning property features with the preferences and needs of the local population, maximizing market fit. |

| Crime Rates and Safety Statistics | Data on local crime rates, safety records, and trends in law enforcement activity. | Ensures properties are located in safe neighborhoods, which is critical for tenant retention, marketability, and property value. |

| Environmental Hazards and Risks | Analysis of flood zones, seismic activity, air quality, contamination risks, and other environmental factors. | Enables proper risk assessment, informs insurance decisions, and ensures compliance with environmental and safety standards. |

| Zoning and Land Use Regulations | Zoning classifications, permitted land uses, restrictions, and local development guidelines. | Helps avoid regulatory issues and identifies development opportunities aligned with zoning laws, ensuring efficient planning. |

Significance of Demographic & Location Data

- Site Selection: Pinpoints ideal locations for commercial, residential, or industrial developments, ensuring alignment with market demand.

- Tenant Targeting: Helps tailor property offerings to match the needs of specific demographics, driving higher occupancy rates and customer satisfaction.

- Market Segmentation: Supports strategic planning by dividing the market into segments based on geographic and demographic factors.

- Consumer Demand Identification: Highlights areas with growth potential, such as regions experiencing economic expansion, population growth, or increased infrastructure investment.

- Risk Management: Mitigates potential issues by analyzing safety and environmental risks, reducing liability, and ensuring long-term stability.

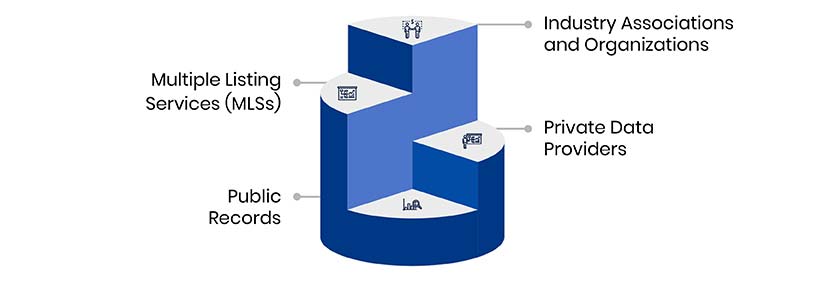

Key Commercial Real Estate Sources

Commercial real estate data sources are as varied as the industry itself, each offering distinct insights to address specific needs. From government archives to advanced analytics platforms, these sources provide more than just numbers—they reveal patterns, trends, and opportunities.

Public Records

Public records consist of official documents preserved by government agencies that deliver essential information for confirming property ownership, historical sales, and regulatory compliance. These records offer transparency, playing a critical role in preventing fraudulent transactions and minimizing errors in decision-making processes. Accessing historical sales data, property tax records, and legal filings ensures thorough due diligence and supports better property evaluations.

- Building Permits and Inspection Reports

- Deed Records and Ownership Information

- Court Records and Legal Filings

Private Data Providers

Private data providers collect, aggregate, and analyze real estate data while offering sophisticated analytical tools and market intelligence reports. These platforms enhance market visibility by providing deep insights into property trends, ownership data, and transaction histories beyond publicly available information. Their benefits include empowering businesses with predictive analytics, detailed market insights and benchmarking tools, all of which help drive smarter investment decisions.

- Real Capital Analytics (RCA)

- MSCI Real Assets

- Cherre

- CompStak

- Reonomy

- Moody’s Analytics REIS

- Green Street Advisors

Multiple Listing Services (MLSs)

Multiple Listing Services function as centralized property databases, facilitating the sharing of property listings and transactional information among real estate professionals. These platforms simplify property discovery while offering insights into pricing trends, transaction histories, and current market availability. Their significance lies in promoting market transparency and streamlining both the buying and selling processes. Benefits include easy property comparisons, improved market visibility and faster deal closures.

- Local and regional MLS databases

- Commercial property listings and transaction data

Industry Associations and Organizations

Industry associations and professional organizations gather market data, generate industry reports, and offer professional development resources. They are instrumental in keeping industry players informed about evolving market conditions, policy changes and professional standards. By providing authoritative insights, networking opportunities, and proprietary research, these associations help businesses make data-backed decisions.

- Building Owners and Managers Association (BOMA)

- Urban Land Institute (ULI)

- NAIOP, the Commercial Real Estate Development Association

Other Sources

Additional data sources, such as company websites, news outlets, and government databases, deliver valuable qualitative insights that complement structured datasets. These sources play a crucial role by providing timely market updates, company financials and emerging industry trends. Professionals use real-time data access, financial performance reports and market sentiment analysis to anticipate market changes and improve their strategies.

- News Articles and Industry Publications

- Market Research Reports

- Government Agencies (Census Bureau, Bureau of Labor Statistics)

- Social Media and Online Forums

- Direct Surveys and Interviews

Conclusion

Managing commercial real estate data is no small feat. Properties, leases, market trends, and financial metrics—keeping track of it all requires expertise and precision. As the CRE industry becomes increasingly competitive, the role of commercial real estate data providers in offering accurate and reliable insights has never been more critical. Leveraging precise, comprehensive data empowers professionals to identify trends, optimize asset management and stay ahead of market shifts.

Looking ahead, the future of CRE data holds immense potential. With advancements in technology, including artificial intelligence and real estate analytics, commercial real estate listing services are set to play a pivotal role in shaping data accessibility and usability. These innovations will bring greater efficiency, precision and innovation to the industry, redefining how CRE professionals operate and reshaping the market itself.

For businesses, partnering with a professional data management company simplifies these complexities, providing tailored solutions that transform data chaos into strategic clarity.

Maximize Property Data’s Potential for Profitability

Gather, validate and update property data for better accuracy and usability.