- Mortgage lenders face substantial financial risks of increased loan defaults and approving high-risk borrowers by neglecting comprehensive foreclosure data.

- Leveraging foreclosure data allows mortgage lenders to identify red flags, make informed decisions, and strengthen their risk assessment frameworks.

- Proactive integration of foreclosure data is essential for lenders to mitigate losses and ensure a stable, sustainable mortgage lending future.

Table of Contents

In the high-stakes mortgage industry, lenders rely on data to assess borrower risk, yet many still operate without complete foreclosure insights.

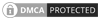

Borrower defaults pose a significant threat to mortgage lenders, often leading to substantial financial losses and increased exposure to bad debt. Without access to accurate foreclosure data, lenders risk approving loans for high-risk borrowers or properties with a history of default jeopardizing the health of their portfolios.

The cost of a single foreclosure can be substantial, factoring in legal fees, property maintenance, and lost revenue. Foreclosure data services help lenders mitigate such risks by offering insights into borrower behavior, property histories, and emerging default patterns.

By integrating these insights into their risk assessment processes, mortgage lenders can identify red flags early, make more informed lending decisions, and strengthen their overall framework for risk management.

In this article, we explore how foreclosure data empowers lenders to assess risks more effectively and safeguard their investments.

Understanding foreclosure data

Understanding mortgage foreclosure data helps lenders effectively navigate risk. This essential information appears in several forms, each showing different aspects of distressed properties. Pre-foreclosure data serves as an early warning system. It shows properties in the initial default stages, which can help lenders reach out to borrowers before situations worsen. Auction data identifies properties headed to foreclosure sales.

This information can create opportunities for acquisition and loss mitigation strategies. REO data tracks properties already taken back by lenders. It offers clear visibility in the final phase of foreclosure proceedings.

These data streams come from diverse sources and are carefully compiled to create a complete picture. Public foreclosure data forms the foundation, with county records, court filings, and legal notices providing the legal backbone of foreclosure proceedings. Specialized real estate data providers collect and organize this scattered information into accessible databases.

Additionally, MLS data offers up-to-date insights into foreclosure listings. This information from real estate agents connects legal records with market realities. The ebb and flow of foreclosure rates are heavily influenced by key economic drivers. Consider these factors:

- Interest Rate Fluctuations: Rising interest rates, particularly for adjustable-rate mortgages, can dramatically increase monthly payments, pushing borrowers toward default.

- Negative Equity: When a property’s value falls below the outstanding mortgage balance, borrowers are more likely to walk away, leading to foreclosure.

- Regional Variations: Local economic conditions, such as job losses and industry downturns, can significantly impact foreclosure rates. For instance, states like Delaware and New Jersey have historically reported higher rates due to specific regional economic challenges.

- Unemployment Rates: A rise in unemployment directly correlates with the ability of homeowners to make mortgage payments on time.

- Legislative Changes: New laws or regulations impact the foreclosure process, influencing both the speed and volume of foreclosure actions.

By understanding these data types, sources and economic drivers, mortgage lenders can build a robust risk assessment framework, minimizing losses and fostering a more stable lending environment.

How foreclosure data empowers mortgage lenders to assess risk

The real use of foreclosure data is, of course, in its practical application: how lenders leverage these insights to bolster their risk assessment strategies and protect their portfolios.

Predicting Borrower Default

Foreclosure data helps mortgage lenders evaluate borrower creditworthiness and predict default likelihood. Lenders can identify high-risk patterns by studying historical foreclosure trends. A borrower’s history of late payments, multiple credit inquiries, or previous foreclosure filings often indicates a higher default probability.

Pre-foreclosure data reveals early warning signs. These include rising debt-to-income ratios or sudden property value decreases. Lenders can also assess local economic impacts by comparing regional foreclosure rates with borrowers’ location.

Some borrowers live in high-foreclosure areas. Their credit scores might look acceptable. However, mortgage default prediction models can highlight external risk factors that might trigger future defaults. These factors matter. By integrating these data points, lenders can develop a more nuanced understanding of a borrower’s financial stability, going beyond traditional credit scores to create a more accurate risk profile.

Evaluating Loan-to-Value (LTV) Ratios

Foreclosure data plays a vital role in mortgage risk assessment, especially when evaluating Loan-to-Value (LTV) ratios. Lenders can gain accurate market insights by studying how foreclosed properties sell compared to their appraisals. This matters. When properties in a neighborhood consistently sell below appraised values, lenders can adjust their LTV calculations to reflect real market conditions.

Patterns revealed by examining property foreclosure data help identify high-risk areas prone to value drops or disruptions. Foreclosure clusters often signal declining property values or economic instability in specific regions. Consider a practical example. When foreclosures surge near a closing factory, lenders can recognize the weakening local housing market and reassess their lending approach accordingly.

Moreover, examining REO data reveals crucial information about foreclosed property conditions. Lenders can learn about potential maintenance costs and resale challenges through this analysis. If many REO properties in a region require significant repairs, lenders can factor this into their LTV assessment, ensuring they’re not over-lending on potentially problematic assets. This allows lenders to create a more accurate LTV ratio and avoid lending on properties that have a higher chance of default.

Portfolio Management and Risk Mitigation

Foreclosure data is indispensable for mortgage lender risk management, enabling proactive decision-making to safeguard loan portfolios. By continuously monitoring loan performance through foreclosure data, lenders can swiftly identify potential problem loans. For instance, a sudden increase in late payments or pre-foreclosure filings within a specific loan segment signals potential trouble.

This allows lenders to implement early intervention programs, such as offering loan modifications or forbearance options, to prevent further defaults. Furthermore, foreclosure analytics for lenders help refine risk mitigation strategies by analyzing historical foreclosure patterns and identifying high-risk loan characteristics. For example, if data reveals a strong correlation between adjustable-rate mortgages and foreclosure spikes during rising interest rates, lenders can tighten lending standards for such loans.

Tracking market trends through foreclosure data also helps lenders anticipate emerging risks. A surge in foreclosures in a particular geographic area, for instance, enables lenders to reassess their exposure and adjust lending practices accordingly. By proactively leveraging foreclosure data, lenders can enhance mortgage lender risk management, minimize financial losses, and ensure a stable, data-driven lending environment.

Monitoring Economic Indicators

Monitoring economic indicators is crucial for lenders using foreclosure data. Unemployment rates, interest rate changes, and inflation significantly impact foreclosure trends, providing valuable context for risk assessment. For instance, a rise in unemployment directly correlates with an increased likelihood of mortgage defaults as borrowers struggle to meet their financial obligations.

Similarly, fluctuations in interest rates, especially for adjustable-rate mortgages, can dramatically affect monthly payments, leading to higher default rates. Inflation, by eroding purchasing power and increasing living expenses, further strains borrowers’ finances, making mortgage payments more difficult.

Lenders who consistently track these indicators can anticipate shifts in foreclosure trends, allowing them to proactively adjust their lending practices and risk-management strategies. For example, if unemployment rates start to climb, lenders might tighten their credit standards or implement more stringent loan-to-value ratios. By integrating economic data with foreclosure data, lenders gain a comprehensive understanding of the market, enabling them to make informed decisions and mitigate potential losses.

Challenges in using foreclosure data and solution

Mortgage foreclosure data is a powerful tool for mortgage lenders, real estate investors, and homebuyers, helping them assess risk, identify opportunities, and make informed financial decisions. However, several challenges can limit its effectiveness. Here’s a look at key obstacles and how they can be addressed:

1. Limited Access to Comprehensive Data

Challenge: Many foreclosure records are spread across different sources, making it difficult to obtain complete and up-to-date information. Inconsistent reporting standards can also lead to data gaps.

Solution: Relying on trusted foreclosure data providers that aggregate property public records from multiple verified sources ensures a more comprehensive dataset. Leveraging AI-driven data aggregation tools can also help streamline information collection.

2. Data Accuracy and Reliability Issues

Challenge: Inaccurate or outdated foreclosure data can result in poor risk assessment and flawed decision-making. Missing details or conflicting reports may mislead lenders and investors.

Solution: Using AI-powered data validation techniques and cross-referencing multiple sources improves accuracy. Selecting foreclosure data services that offer real-time updates ensures more reliable insights.

3. Privacy and Security Concerns

Challenge: Foreclosure data often includes sensitive borrower information, raising concerns about privacy protection and data security. Improper handling can lead to legal and compliance risks.

Solution: Choosing foreclosure data providers that adhere to strict data protection regulations (GDPR, CCPA) and implement encryption and access controls helps safeguard information. Regular audits and cybersecurity measures further strengthen security.

4. High Costs of Accessing and Maintaining Data

Challenge: High-quality foreclosure data services often require significant investment, making it costly for smaller firms and individual buyers to obtain detailed insights.

Solution: Opting for subscription-based foreclosure data models or pay-per-use services can help manage costs. Some public foreclosure databases and cloud-based solutions offer cost-effective alternatives.

5. Need for Specialized Analytical Skills

Challenge: Having foreclosure data is not enough, analyzing market trends, identifying risks, and drawing actionable insights requires data expertise and advanced analytics tools.

Solution: Mortgage lenders and investors can adopt AI-driven foreclosure analytics platforms that simplify data interpretation. Training staff in data analysis and predictive modeling or outsourcing analytical tasks can also enhance decision-making.

6. Ethical Considerations and Responsible Use

Challenge: Misusing foreclosure data for predatory lending, unfair practices, or misinformation can harm borrowers and damage reputations.

Solution: Ensuring transparent, fair, and responsible use of foreclosure data builds trust and credibility. Adhering to ethical lending practices and following industry regulations help maintain integrity in real estate and financial decision-making.

By overcoming these challenges, mortgage lenders, real estate professionals, and investors can leverage foreclosure data more effectively, leading to smarter decisions and reduced financial risks.

Future trends in foreclosure data and risk assessment

The future of foreclosure data and risk assessment in mortgage lending is poised for significant transformation, driven by emerging technologies and evolving industry needs. We can anticipate a surge in the use of AI and machine learning, enabling lenders to build sophisticated predictive models that identify high-risk borrowers with greater accuracy.

For example, AI algorithms can analyze vast datasets, including social media sentiment and alternative credit data, to forecast default probabilities beyond traditional credit scores. Real-time data integration via APIs will expedite risk assessment, allowing lenders to react swiftly to market changes. Imagine a system that instantly updates property values based on local sales data, enabling precise LTV calculations.

Data visualization and geospatial analysis will become essential for identifying and managing regional risks. Lenders could use interactive maps to visualize foreclosure hotspots, revealing patterns and correlations that inform targeted interventions.

Furthermore, blockchain technology promises enhanced data security and transparency, creating immutable records of property transactions and reducing fraud. As an example, a blockchain system can track property ownership changes and ensure that all records are verifiable. Concurrently, a heightened focus on data privacy and ethical considerations will shape data usage practices, ensuring responsible and equitable lending.

These trends will reshape the mortgage lending industry, enabling proactive risk management, streamlined processes, and more informed decision-making, ultimately fostering a more stable and resilient mortgage ecosystem.

Conclusion

Foreclosure data stands as a critical tool for mortgage lenders, enabling precise risk assessment through insights into borrower behavior, property valuation, and market trends. By leveraging this data, lenders can make informed decisions, mitigate losses, and promote responsible lending.

Staying abreast of evolving data trends and adopting best practices is paramount. Lenders must embrace technological advancements, partner with reliable foreclosure data providers, and prioritize ethical data usage. We urge mortgage lenders to proactively integrate foreclosure data into their strategies, securing a more stable and sustainable future for the industry.

Don’t let hidden foreclosure trends derail your portfolio.

Want to spot red flags early and safeguard your mortgage investments?